SAP Finance: How to configure SAP GL document splitting

August 31st, 2017

3 min read

By David Schenz

The document splitter plays a crucial part in the derivation of profit center and consequently in the preparation of management financial statements. Now we'll take a deep dive into document splitting.

There are two prerequisites for using the splitter. First, the NewGL must be active in the box. That should be the case of any recent implementation. Second, there should be an understanding of the desired coding block and the business interpretation of the coding block elements.

Document splitting characteristics

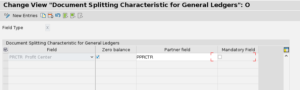

The first step to configuring document splitting in SAP is to determine which coding block elements that you will want to have as document splitting characteristics. A document splitting characteristic will be acted on by the splitter to derive more detailed postings.1

The partner field is used for cross-characteristic postings. For instance, in a posting spanning two profit centers A and B, the debit balance on one profit center A has partner profit center B, and the credit balance on profit center B has partner profit center A. It's very similar to trading partner for those familiar with that concept.

There are two more options for each characteristic. First, whether the field is mandatory—that is it must be populated on all GL line items. Second, whether the field is zero balanced—whether the sum of the postings must equal zero (debits=credits).

For instance (and most common), if the profit center is set as a mandatory zero balancing characteristic, each line item on a posting must have a profit center and the total (debits-credits) of each profit center must be zero.

Configuration model

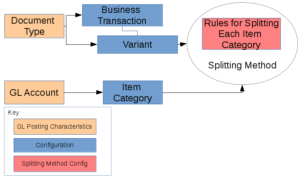

The second key to understanding how the splitter is configured is to understand the theoretical model of the configuration. Once these areas are understood, it becomes much easier to guess what the configuration is doing. In the tradition of help.sap.com, I've created the informative diagram below (Ha! Ha! Ha!) .

The critical information to glean at this step is that each GL account is assigned to an Item Category and each Document Type is assigned to a Business Transaction Variant. Finally, in the Splitting Method, we establish rules for each Business Transaction Variant on how each item category will be derived. This information is confusing, but it's key to understanding the nature of the splitter. Memorize it if you must.

Next, we'll walk through different splitting scenarios.

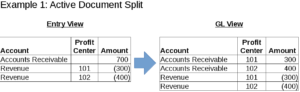

Active document split

The pièce de résistance of the NewGL, the active document split, is the standard example used by most FICO consultants. In this scenario, an AR item is offset by two revenue items. Each revenue line item has a different profit center. In the GL View, the splitter breaks the AR line item into two line items—one for each profit center. Furthermore, the amounts on each posting is based on the weighted average of the offset line items. Read that twice—it's tricky.

When we get to the active document splitting configuration, the key to this example is that the AR item category is split by the revenue category.

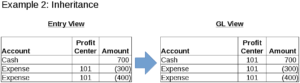

Inheritance

Once you have active split down, inheritance is much easier. The key here is that if a posting has one blank line item and all other line items have the same profit center, then the blank line items will receive the same profit center. In the below example, we have a cash item without a profit center that has two expense items with PC 101. In the GL view, the cash item will receive the same profit center.

Inheritance is turned on by default for all business transactions. You do have the option of turning it off at the rule level, but I've never seen a reason to do so.

Inheritance is turned on by default for all business transactions. You do have the option of turning it off at the rule level, but I've never seen a reason to do so.

Passive split

The third type of splitting, is the passive split. The passive split is simple and it's used whenever you reverse or clear a document. For reversing a document, the splitter will reverse the posting with the exact same profit center derivation as the document being reversed. This makes intuitive sense. The reversal should reverse out the original posting exactly, regardless of the configuration.

Second, for lines that are being cleared, the clearing line items will receive the same profit center split. This approach also makes intuitive sense. If we have an AR line item with $500 on profit center 101 and $300 on profit center 102, then we would expect the clearing document to wipe away $500 on 101 and $300 on 102.

For more support, contact our team of ERP consultants at erpsuites.com.

1 SPRO > Financial Accounting (New) > General Ledger Accounting (New) > Business Transactions > Document Splitting > Define Document Splitting Characteristics for General Ledger Accounting

David Schenz is a leader in building teams that deliver complex business systems transformations and roll-outs. With nearly ten years SAP experience, he offers deep knowledge of retail accounting processes, insurance accounting, and retail business strategies. As Director at ERP Suites, David guides employees toward a common goal of helping customers achieve optimal success.

Topics: