SAP Finance: How to configure house bank accounts in SAP FICO

August 30th, 2017

3 min read

By David Schenz

House bank accounts (HBAs) in SAP are often configured incorrectly during an implementation. This improper configuration causes problems later when additional sub modules such as Electronic Bank Statement (EBS), Cash Forecasting, and Check Reconciliation are brought into scope. In this article, we explore how house bank accounts connect to physical bank accounts, some key settings, and common pitfalls to avoid.

What is a house bank account?

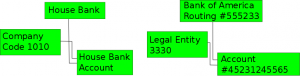

A house bank account represents a bank account that the company has opened with a bank. There should not be a house bank account for customer, vendor, or competitor bank accounts. HBAs should only be setup for a company's own bank accounts. Second, each HBA should represent one single bank account and one bank account should only be represented by one HBA. If there are multiple house bank accounts with the same account number, check clearing and EBS operations will be negatively affected.

It's also important to note that when a bank account is opened, it is opened by a single legal entity. So if a company with fifty legal entities opens a bank account, the account is still owned by one entity inside that company. We see this relationship in SAP in that a single company code is assigned to the HBA.

What is a house bank?

If a house bank account represents a company's bank account, then the house bank (HB) represents the bank that the account is maintained at. So suppose a company has account 523552 at Bank of America with routing number 52389593, then the house bank account will be tied to account 523552 and the house bank will be tied to routing number 52389593. Let's suppose that you have multiple Bank of America accounts with different routing numbers. Should you have a different HB for each routing number? Yes—SAP only enables one routing number per house bank.

Naming house bank accounts

SAP gives us four characters to name each house bank and each house bank account. That of course means that we must be pithy and smart about our naming convention. Most companies only have one or small number of banks that they have accounts with. At the same time, there may be a few routing numbers for the same bank. Thus, multiple house banks may be required for the same bank. With that information, a sensible naming scheme for house banks seems to be AAA# where AAA is an abbreviation for the bank name —such as BOA for Bank of America or FTB for Fifth Third Bank—and # is a sequential number for each routing number at that bank.

Similarly, we must be careful about naming house bank accounts. Best treasury practices suggest that accounts should be segregated to only have one type of activity. So disbursements should be executed out of one account and collections should be in a separate account. Thus, a reasonable practice would be to use an abbreviation for the type of activity and a sequential number. I would do AA## with AA being the short hand for the activity type and ## being a sequential number.

GL accounts for house bank accounts

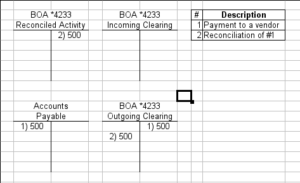

Most flows in bank accounting revolve around recording a companies cash activity and then reconciling against how the bank recorded that activity. As part of a monthly close operation, bank statements and internal accounting records should be reconciled against one another.

The standard recipe in SAP for cash accounting flows is that say when a payment is issued, a clearing account tied to the house bank account is credited and the vendor account is debited. Then, when the payment shows up on the bank statement, the clearing account is debited and the G/L tied to the HBA is credited. That means that the account tied to the HBA should always represent the reconciled activity (and match the balance per the last statement date), while the clearing accounts represent unreconciled activity.

Usually, there are more than one clearing accounts used depending on how much activity is flowing through the account. If the HBA GL account is 444440, then clearing accounts should be numbered 444441,444442,...,444449. If the account has low volumes, then only a clearing account for incomings and another for outgoings may be required. If the account has high volumes, then a separate account should be used for each type of activity (lockbox, ACH payments, check disbursements, etc).

Configuring house bank accounts

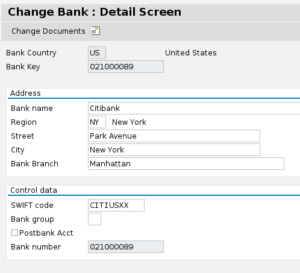

First, the house bank must be setup as a bank in FI01. The bank really is just used so that SAP is aware that the bank's routing number is valid and to have a consistent address for the bank. Often times, a file is prepared and mass loaded with all of the known banks in a country to avoid having do to this step every time.

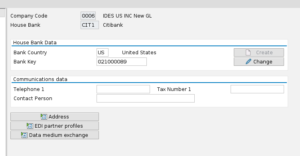

Next, the house bank is setup in FI12. First, we're prompted for the company code of the house bank. Next, a code is assigned to the house bank as previously detailed. The country should be denoted as well. If there is a need for additional payment settings, these can be entered under the DME section.

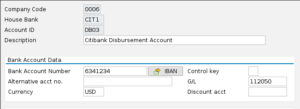

Once the house bank is created, the house bank account should be configured. Key information here is the Account ID, the description, the account number, the GL account, and the currency.

Once all of this information is saved, then the house bank account is ready for use in other cash flows such as lockbox, EBS, cash forecasting, and so on.

David Schenz is a leader in building teams that deliver complex business systems transformations and roll-outs. With nearly ten years SAP experience, he offers deep knowledge of retail accounting processes, insurance accounting, and retail business strategies. As Director at ERP Suites, David guides employees toward a common goal of helping customers achieve optimal success.

Topics: