SAP Finance: How to configure Lockbox for Cash Application

August 2nd, 2017

3 min read

By David Schenz

The United States, unlike much of the world, still relies heavily on paper checks for payments. In order to facilitate internal control and to streamline processing, many companies utilize a lockbox service at a bank. In this article, we'll examine the process flow for Cash Application via Lockbox, discuss a few keys to success, and then examine the configuration and technical details in SAP.

Lockbox process

-

A customer orders products from a company. The company sends the products to the customer.

-

The company invoices the customer. On the invoice, the vendor includes a voucher. The voucher includes the invoice number and customer number.

-

The customer mails their check with the voucher to the bank that the lockbox is setup with.

-

The bank deposits the cash. The bank's staff will capture the information off the customer's check, possibly the information on the voucher, and possibly an image of the check.

-

The bank sends the company a file with all of the captured payment information.

-

The company uses the payment file from the bank in order to apply payments against the customer invoices.

-

Any errors during step 6 must be manually researched and resolved.

BAI2 overview for SAP Lockbox

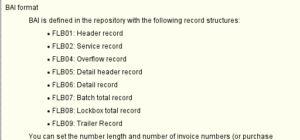

Setting up Lockbox processing starts with getting a correctly formatted file. SAP requires the file to be formatted in what it calls the BAI2 format. This is not the BAI2 layout that the rest of the world considers the BAI2 format. It is the BAI2 format for lockboxes. SAP thankfully gives us the layout for the file, but not a lot of detail about what is going on. From the help documentation in FLB2, we see that the layout of the file is contained in tables FLB.

You can view the fields in each of those tables to see what fields should be contained in the file. The Lockbox file if a fixed width text file. Even if the field is not being used, spaces should be added to the field. All of the meat of the file is in record types 5, 6, and 4. Record type 5 contains the lockbox information, record type 6 contains the check information as well as any invoice numbers that are being cleared. Record type 4 is an overflow of record type 6 and is used for adding additional invoices if they do not all fit in record type 6.

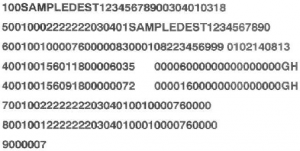

An example of the layout from the SCN wiki is below. You can see that the record type is the first digit of each line.

Some banks are able to actually send the file in the correct format. Other banks are not able to do so and instead a custom program will need to translate the file out of the bank's format and into the BAI2 lockbox format that SAP expects.

SAP Lockbox configuration

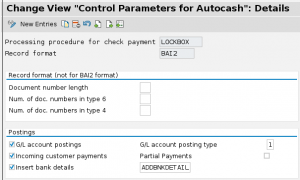

The first step in the configuration is to set the control parameters for lockbox processing. This step is usually already done by default in most ECC 6.0 installations, but you should double check the settings.1

The most important setting here control the postings in the lockbox process. The standard set of journal entries are:

Dr Bank Account

Cr Incoming Payments

Dr Incoming Payments

Cr Customer Account

The settings in this config screen will determine how and if the postings are made. Have a look at the help text for each for more in depth discussion. The next screen has the setup for each individual lockbox.2

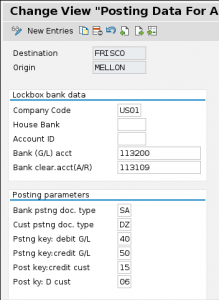

Here, the origin and destination that is coded in the Lockbox file is entered. Additional parameters such as GL accounts to use for the bank and clearing accounts, document types, and posting keys can be selected. If you choose to code this activity to a house bank account that you setup in FI12, then it can be connected here.

That should give us enough configuration to process a lockbox file. There are other configuration items such as reason codes in AR, default profit centers in the GL, house banks in cash accounting, and disputes in FSCM Dispute Management that integrate here as well, but these are a separate topic and will make a long post even longer. Let's look at the Lockbox processing screen:

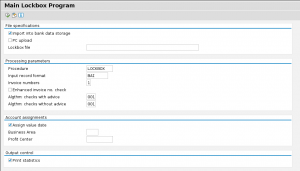

A couple of key items here that impact processing in a big way. The procedure and format should match what is configured in our first config screen. The field "Invoice Numbers" is incredibly important as it determines how the invoice numbers on the Lockbox file will be matched to the FI document numbers.

Any items that do not match an invoice after FLB2 is run will show up in FEBA_LOCKBOX. This screen is used for post processing and fixing errors.

Keys to success in SAP Lockbox processing

There are a few critical points in the process to ensure that Lockbox Cash Application has a high hit rate.

- Bank integration: The bank who is providing the Lockbox file must be on board with providing enough information. Similarly, the treasury department must be willing to pay the fees to capture the information

- Cross CoCd payments: If the Lockbox belongs to one company code and the payments are being received in another, then enhancing a user exit will be necessary.

- Updates during post processing: Each time that a payment is applied manually, the customer's bank information should be updated. This approach requires enhancement.

- Routine error handling: All Lockbox issues and unapplied cash should be examined on a daily basis. If these problems back up, it can make for an ugly close at month end.

For more support, contact our team of ERP consultants at erpsuites.com.

1 SPRO > Financial Accounting > Bank Accounting > Business Transactions > Payment Transactions > Lockbox > Define Control Parameters

2 SPRO > Financial Accounting > Bank Accounting > Business Transactions > Payment Transactions > Lockbox > Define Posting Data

David Schenz is a leader in building teams that deliver complex business systems transformations and roll-outs. With nearly ten years SAP experience, he offers deep knowledge of retail accounting processes, insurance accounting, and retail business strategies. As Director at ERP Suites, David guides employees toward a common goal of helping customers achieve optimal success.

Topics: